Taken from BBC News:

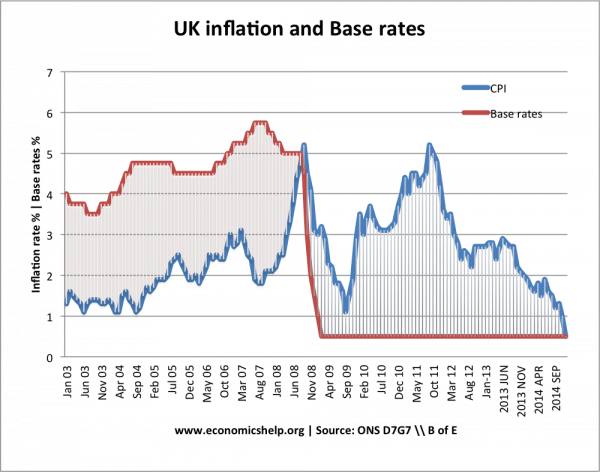

"A whole generation of mortgage borrowers who have never seen a rate rise are in for a shock. When they can't afford it, spending will be slashed.

The slowdown will get worse. The economy will tank!

That, at least, is the scary story. And here's why it seems like it may be true.

The US central bank, the Federal Reserve, raised official interest rates from their post-crisis low last month, the first rise in nearly a decade. Historically, the UK tends to follow close behind.

And British households, with their record unsecured borrowing and sizeable mortgages, are more vulnerable to rate rises than they are over there".

Full story here:

Who's afraid of the big bad rate rise? - BBC News

"A whole generation of mortgage borrowers who have never seen a rate rise are in for a shock. When they can't afford it, spending will be slashed.

The slowdown will get worse. The economy will tank!

That, at least, is the scary story. And here's why it seems like it may be true.

The US central bank, the Federal Reserve, raised official interest rates from their post-crisis low last month, the first rise in nearly a decade. Historically, the UK tends to follow close behind.

And British households, with their record unsecured borrowing and sizeable mortgages, are more vulnerable to rate rises than they are over there".

Full story here:

Who's afraid of the big bad rate rise? - BBC News

Comment