- Visitors can check out the Forum FAQ by clicking this link. You have to register before you can post: click the REGISTER link above to proceed. To start viewing messages, select the forum that you want to visit from the selection below. View our Forum Privacy Policy.

- Want to receive the latest contracting news and advice straight to your inbox? Sign up to the ContractorUK newsletter here. Every sign up will also be entered into a draw to WIN £100 Amazon vouchers!

BoE raises interest rates to stem massive looming inflation

Collapse

X

-

-

-

Originally posted by SueEllen View PostI blame the condems

condoms

If they were any good we would not have to put up with those deflationary types...Comment

-

While the continue to print money which, ironically, creates inflation! My what a wonderful world these bankers live in.

Besides, with all the money the US has printed, the BOE raising rates won't make a tiny bit of difference.McCoy: "Medical men are trained in logic."

Spock: "Trained? Judging from you, I would have guessed it was trial and error."Comment

-

Can you explain? In what sense is the BoE "continuing" to print money, given that QE has been frozen for months. In fact, in what sense is QE "printing money" in the first place?Originally posted by lilelvis2000 View PostWhile the continue to print money which, ironically, creates inflation! My what a wonderful world these bankers live in.

Besides, with all the money the US has printed, the BOE raising rates won't make a tiny bit of difference."A life, Jimmy, you know what that is? It’s the s*** that happens while you’re waiting for moments that never come." -- Lester FreamonComment

-

0.5% official rate when real inflation is well over 5% is the same as printing money.Originally posted by Freamon View PostIn fact, in what sense is QE "printing money" in the first place?

HTHComment

-

There's more than one logical leap of faith in that statement.Originally posted by AtW View Post0.5% official rate when real inflation is well over 5% is the same as printing money.

HTH

Is "inflation" only ever due to printing money?"A life, Jimmy, you know what that is? It’s the s*** that happens while you’re waiting for moments that never come." -- Lester FreamonComment

-

No, theresOriginally posted by Freamon View PostThere's more than one logical leap of faith in that statement.

Is "inflation" only ever due to printing money?

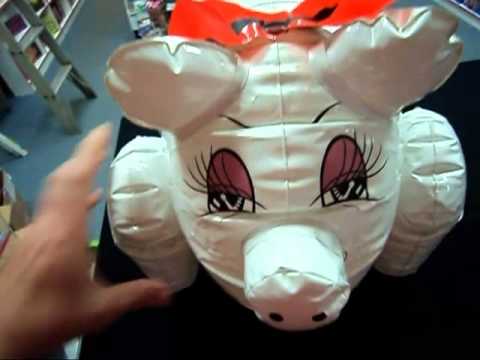

this kind of inflation as wellDoing the needful since 1827Comment

-

Markets sentiment is that leaving UK base rates unchanged is more destructive to the £ than a tsunami.

Sterling is down over 1% against the Yen today. Japan, which has and continues to suffer its biggest earthquake in recorded history and the 7th biggest in history globally, and which will presumably cost untold trillions of Yen to the economy, is on firmer ground than the UK.Comment

-

1.3% down now.Originally posted by TimberWolf View PostMarkets sentiment is that leaving UK base rates unchanged is more destructive to the £ than a tsunami.

Sterling is down over 1% against the Yen today. Japan, which has and continues to suffer its biggest earthquake in recorded history and the 7th biggest in history globally, and which will presumably cost untold trillions of Yen to the economy, is on firmer ground than the UK.Comment

- Home

- News & Features

- First Timers

- IR35 / S660 / BN66

- Employee Benefit Trusts

- Agency Workers Regulations

- MSC Legislation

- Limited Companies

- Dividends

- Umbrella Company

- VAT / Flat Rate VAT

- Job News & Guides

- Money News & Guides

- Guide to Contracts

- Successful Contracting

- Contracting Overseas

- Contractor Calculators

- MVL

- Contractor Expenses

Advertisers

Contractor Services

CUK News

- Streamline Your Retirement with iSIPP: A Solution for Contractor Pensions Sep 1 09:13

- Making the most of pension lump sums: overview for contractors Sep 1 08:36

- Umbrella company tribunal cases are opening up; are your wages subject to unlawful deductions, too? Aug 31 08:38

- Contractors, relabelling 'labour' as 'services' to appear 'fully contracted out' won't dupe IR35 inspectors Aug 31 08:30

- How often does HMRC check tax returns? Aug 30 08:27

- Work-life balance as an IT contractor: 5 top tips from a tech recruiter Aug 30 08:20

- Autumn Statement 2023 tipped to prioritise mental health, in a boost for UK workplaces Aug 29 08:33

- Final reminder for contractors to respond to the umbrella consultation (closing today) Aug 29 08:09

- Top 5 most in demand cyber security contract roles Aug 25 08:38

- Changes to the right to request flexible working are incoming, but how will contractors be affected? Aug 24 08:25

Comment