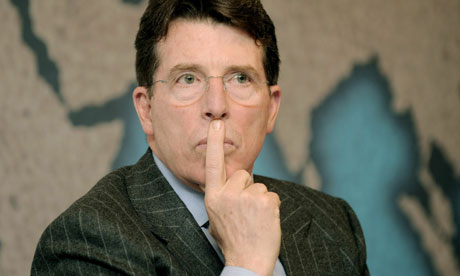

It is there in black and white for any one who takes the time to read the terms under which Bob Diamond was appointed chief executive of Barclays bank.

Dated January 2011, when he took on the top job after more than a decade running the investment bank, the employment terms read: "Barclays will consult with you in good faith and give consideration as to whether and in which ways Barclays can hold you harmless against any incremental tax liability incurred as a result of your return to the UK to perform your assignment".

By way of the background, shortly after the collapse of Lehman Brothers in October 2008, when Barclays bought the Wall Street operations of the defunct firm, Diamond went back to his native America to oversee the crucial integration.

Barely 12 months later, he was promoted to the top job that required him to come back to his adopted home in the UK (he has British citizenship).

While the potential of holding him "harmless against incremental tax liability" is spelt out, the size of the bill - £5.7m - has proved to be shocking. As is the admission by Barclays that there is likely to be another payment in 2012, albeit a "significantly reduced" one.

The Barclays annual report describes the £5.7m it has paid to the exchequer as "tax equalisation" because of the differing tax treatment between capital gains on historic share awards in the US and the UK which could not be offset by a double taxation treaty between the two countries. (AtW's comment: WTF is going on here - taxation is private matter and if Bob did not like the deal he had due to higher tax he should not have taken it. It's totally crazy company pays money to settle tax bill - was this payment tax as UK income??!)

As has been previously reported, Diamond is employed by Gracechurch Services Corporation, a subsidiary of the bank, and has an "assignment agreement" with Barclays that spells out the terms of him becoming chief executive. (AtW's comment: now that's interesting - top boss, CEO isn't actually emlpoyed by the bank but "secoded" from another firm?!?!)

While this appears overly complicated, Barclays insists that it employs a number of its bankers this way to allow them to keep continuity of US benefits, particularly for healthcare. Is that unusual? His counterpart at HSBC, Stuart Gulliver, is seconded to work for HSBC Holdings - the overall opeartion - through a Dutch-based HSBC Asia Holdings, again intended to give global bankers continuity in their benefits and pensions.

Shareholders have a fortnight to decide whether the tax bill was a price worth paying to bring Diamond back to the UK. One of the largest shareholders is Blackrock, the fund manager to which Barclays Global Investors was sold and on which Diamond has a seat on the board. How might it vote with its 7% stake? The decision, it seems, will be taken by an independent fiduciary to avoid potential conflicts.

The shareholders who are now considering whether to vote against the Barclays remuneration report at the annual meeting might want to ask themselves whether they should have sought more clarity on that pledge by Barclays to make Diamond "harmless" to any tax inequalities.

Equally the board of Barclays might need to explain why it needed to offer Diamond such a clause in his employment to promote him to a role he clearly wanted. Richard Murphy, director of Tax Research pointed out: "Ego is a sufficient compensation for having to pay all that tax".

Source: Bob Diamond and the question of tax equalisation | Business | guardian.co.uk

Comment