Filling this in for last year (yes I know it's rather late....oooops)

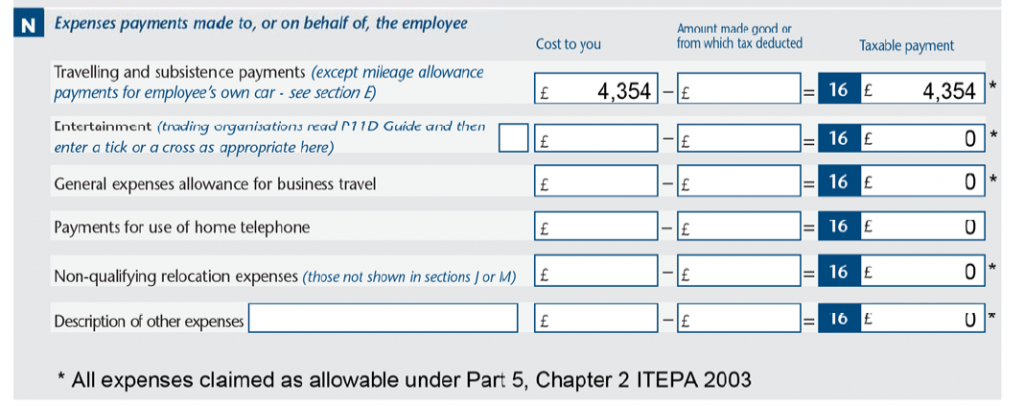

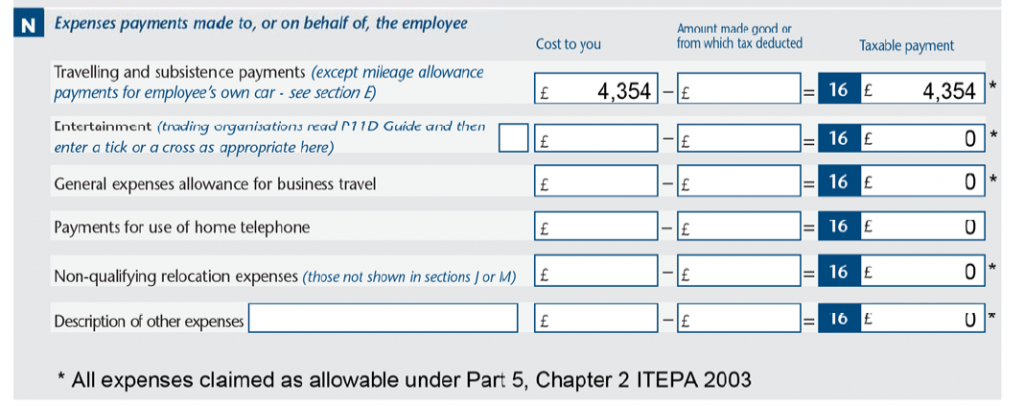

I'm not sure whether I should separate out the £5 a night allowance for staying away from home from "Travel and subsistence payments" and put it under "General expenses allowance for business travel"

What do you think please?

Also where would I put the £10 a month I was claiming for business calls incurred on my personal mobile? On the last line?

Cheers

P.S. Fixed all my ills in my last post by "writing off" £341 from the directors loan account (which was +ve, i.e. Ltd owed me money). At worse the Ltd pays 20% CT on the £341 as the money hasn't disappeared and maybe one day I'll work out the discrepancy and factor it back in...unlikely I'd dig that deep though to be honest.

I'm not sure whether I should separate out the £5 a night allowance for staying away from home from "Travel and subsistence payments" and put it under "General expenses allowance for business travel"

What do you think please?

Also where would I put the £10 a month I was claiming for business calls incurred on my personal mobile? On the last line?

Cheers

P.S. Fixed all my ills in my last post by "writing off" £341 from the directors loan account (which was +ve, i.e. Ltd owed me money). At worse the Ltd pays 20% CT on the £341 as the money hasn't disappeared and maybe one day I'll work out the discrepancy and factor it back in...unlikely I'd dig that deep though to be honest.

Comment