Forget 40 days, us AMS contractors actually face an 85-day wait to get paid

If contractors unaffected by the AMS Framework thought that 40-day payment terms sounded bad enough, the reality for us covered by the almost month-old agreement is actually likely to end up being a lot, lot worse, writes a procurement consultant with more than 15 years’ professional contracting experience.

I say ‘end up being’ intentionally, because some recruitment agents have reported that they have secured a concession for the first payment due to be made under the framework --- scheduled for Friday July 13th.

So whether it is thanks to ContractorUK’s coverage of our plight, or due to other external pressure (affected recruitment agencies for example), Alexander Mann Solutions (AMS) has agreed to pay the initial band of SMEs which have come across from Capita’s CL1 Contract within just 25 days. That means that AMS is going to allow 10 days for the much-disliked ‘self-billing’ process, and then pay the amounts raised on those bills within just 15 days.

55-day payment wait

Again, I use a word here purposefully -- ‘just.’ Because while many professional contractors would understandably still sneer at it taking two weeks or so just to receive money they are owed, our payment terms will not only be 40 days usually; they’re actually likely to be more like 52 or 55 days.

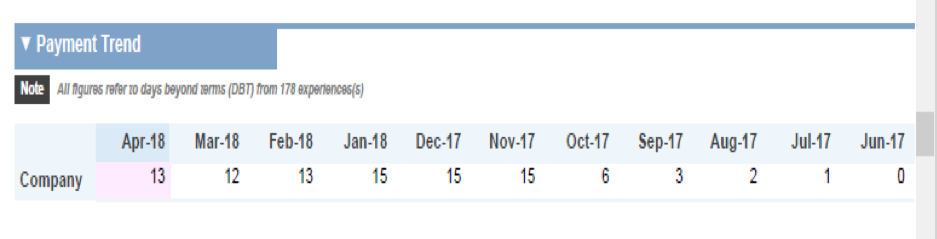

Why? Well, despite AMS claiming as they did to ContractorUK that they have an “exemplary track record in meeting our contractual obligations,” their average payment terms for their private sector contracts to date are, in practice, beyond what is says in the contracts. In fact, in the last six months, AMS has been tracking at between 12 and 15 days over their contracted payment terms. Simply pull down an independent financial report on AMS (an extract from Graydon UK’s is below), to see what is proof of anything but ‘exemplary’ practice on paying suppliers.

What this means for contractors seems to go beyond just being ‘cashflow-constraining;’ it’s potentially company-crippling. At least it might be for me. Because it means there is a risk that the agency in the chain will not be paid in the 40 contracted days -- but will actually have to wait for up to 55 days instead. So as you can see, if you thought 40 days was bad enough, ‘you ain’t seen nothing yet.’ Oh and you probably won’t see anything-- in cash terms, until almost two months beyond when you invoiced for services you supplied if you’re an AMS contractor.

But in practice, it’s going to be worse than that. And this is a crucial point that those unaffected by the AMS framework are overlooking. While it might take up to 55 days for contractors’ invoices to get paid, that doesn’t mean I get my money on day 56.

From 55 days to 70 days (and potentially beyond)

In fact, the payment terms that Crown Commercial Services have accepted (CCS replaced Capita with AMS in June), are 10 days to self-bill; 30 days to pay undisputed invoices to the agency, plus a Terms & Conditions flow-down the agency has in place requiring potentially a further 30 days until the contractor/SME receives the money! That adds up to grand total of around 70 days (equating to 10 weeks), simply to get paid if you’re a contractor on the AMS Framework with an agency in the chain.

But believe it or not, it’s even worse than that. Because consider the following;

10 days Self-billing

30 days Contracted to pay Agency under AMS

15 days Late payment tendency (see the above extract from Graydon UK’s website)

30 days Agency to pay contractor (T&C flow-down)

TOTAL: 85 days

So yes, don't adjust your screens -- a grand total of potentially up to 85 days to get paid for services supplied under the AMS framework. Almost unbelievable. The impact on contractors’ cash flow and their companies’ commercial risk is, in my career experience, unprecedented.

Informally, CCS has said that the PCR Regulations only required them to contractually pay the agency at 30 days. However when I went to school 10 + 30 = 40. I’ve also heard that AMS has an aspiration to conclude the self-invoice process within three days.

Hopes, HMRC and wishes

Us contractors can only hope that three days is indeed honoured (the three days is not contracted), while we keep compliant by following HMRC’s clarifications on self-billing. Helpfully, the Revenue has made clear that where no invoice is required (e.g. in a self-billing arrangement) then the tax point is the date of supply. HMRC has also published an additional guide on self-billing arrangements which, interestingly, require the contracted parties to agree to such an arrangement in advance (which we have not).

Many moons ago, Capita was criticised for its CL1 framework agreement, mostly because of potentially adverse implications for contractors under IR35. The agreement did abide the 80%/5-day rule however, and it complied with HMRC’s requirements regarding the ‘payment clock’ starting on the date of supply. But it’s potential IR35 connotations were so bad that many wished for something entirely different. In my 15-plus years as a professional contractor, I cannot think of a better real-world example of ‘be careful what you wish for.’