Working through HMRC’s off-payroll (IR35) rules: a step-by-step for PSCs

With the reform of IR35 in the private sector fast-approaching on April 6th 2021, there seems more than ever a sense of frustration and confusion among contractors, which can make navigating the reform’s impact even more difficult, writes Helen Christopher, operations director at Orange Genie.

What is private sector IR35 reform?

Up until April 6th 2021, off-payroll workers supplying the private sector are all responsible for their own IR35 status, and if they get it wrong then their limited company (also known as a Personal Service Company – ‘PSC’) is responsible for any unpaid tax. From 06/04/21 however, the responsibility to determine the IR35 status of the contract falls on the end-client, unless the end-client is deemed to be “small” under the Companies Act.

Over recent months and weeks, private sector end-clients have been assessing their positions with regards to the new IR35. On a daily basis, there are more instances of commercial organisations choosing not to engage with PSCs, in the hope of, ‘No PSCs = no need to bother assessing PSCs for IR35 under the new IR35 legislation.’ Meanwhile, other organisations are applying blanket determinations and ‘forcing’ contactors to join the payroll or an umbrella company and therefore be full-time employed. It’s not surprising contractors are feeling dazed and confused. But what does it all mean, and where should you begin as a PSC contractor?

Blanket decisions

Starting with HSBC back in May 2019, the private sector labour market has seen many end-clients determine that they will no longer engage with PSC contractors post-April 2020 (the original start date of the reforms). With end-clients required to apply “reasonable care” when assessing the IR35 status of their contractors, it’s not surprising perhaps that many contractors have condemned these ‘blanket’ decisions as “illegal” and “not allowed” under the revised Off Payroll legislation (the final wording of which we do not have, despite new guidance from HMRC for its internal usage).

But what we do have here is a straightforward loophole for the end-clients. The revised IR35 rules only apply to PSCs, so if an end-client does not engage with PSCs then they do not have to comply with the new obligations. It may be a subtle difference but technically when an end-client like HSBC announces that they will no longer work with PSCs, they are announcing a ‘corporate policy’ on their engagement with contractors. The outcome is the same: no opportunity to work outside IR35, but this is legally different from a blanket determination.

A blanket determination happens when an end-client continues to work with PSCs but rather than assess their contractors individually, they choose to apply a blanket assessment over the whole (or part) of the contractor workforce.

What do I need to do now?

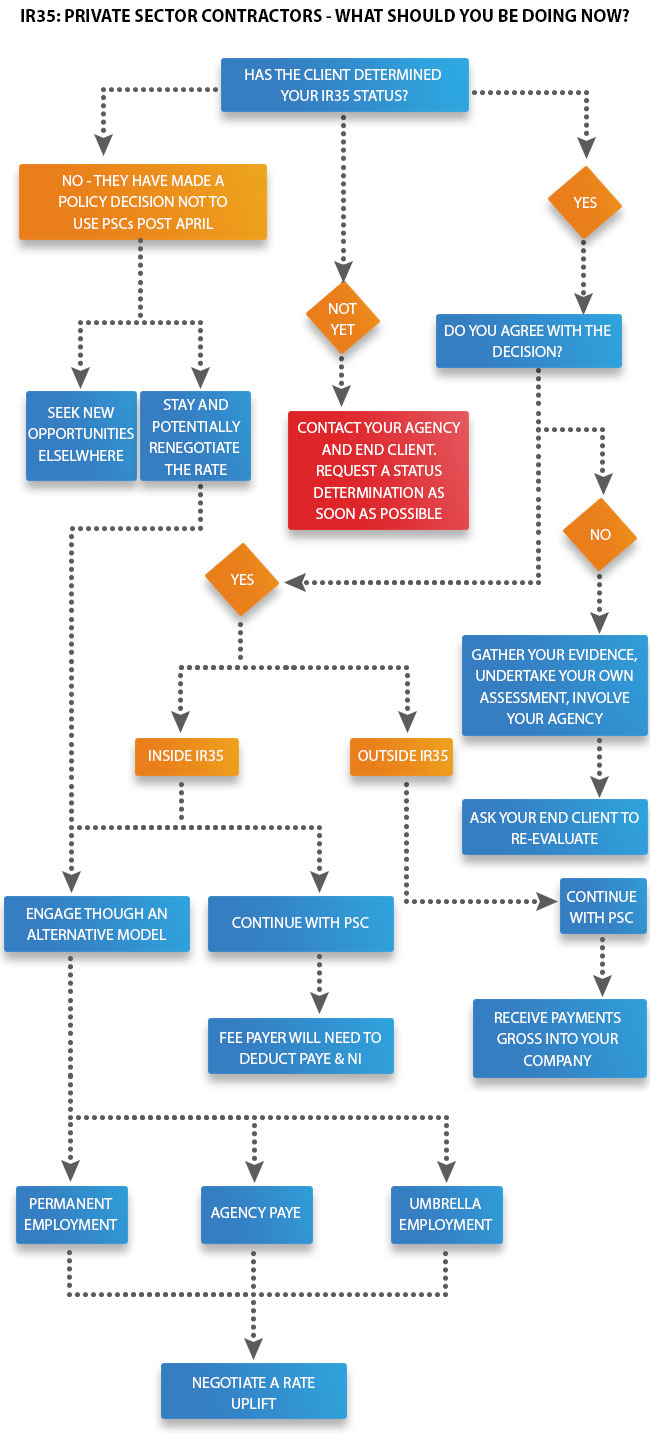

Listening to the conversations our team are having with our contractor clients, many find themselves faced with ‘blanket’ decisions, or worse still an end-client who has yet to engage with them about their future under the new IR35! This incoming legislation is an absolute minefield for contractors to navigate, but the following graphic should provide a practical ‘way-through’ for PSCs.

As the chart shows, if you are a contractor affected by a ‘blanket’ decision, also known as a ‘PSC ban,’ you really have just two initial options at this stage.

Your options if your client is no longer engaging PSCs

First, you can clearly just leave and look for alternative opportunities with end-clients who are more open to working with PSCs on an ‘Outside IR35’ basis. Despite the headlines, these businesses do exist. Many, less large brands are working hard to adapt working practices and engagements to ensure they can attract and retain the best talent.

Second, you can remain with the end-client, albeit under their new engagement model (PAYE umbrella, for example), but we then recommend you try to negotiate an uplift in your rate, as part of a new ‘benefits package’ to reflect the invariably more taxing change in your circumstances. We understand that securing an uplift as part of such a package is easier said than done.

The silent treatment (should not be tolerated)

Yet if ‘silence is golden’ as far as your end-client is concerned, and you have had no communication as to how they intend to deal with IR35 post-April 2021, you should contact your agency and end-client immediately and politely object. Both parties have obligations and liabilities that mean they can no longer pay you without carrying out this assessment – they need to take action and it needs to be fast, because the new IR35 rules apply to all services provided after April 6th 2021.

Ideally, your end-client will understand the continued importance of engaging with PSCs and will have taken advice and action to discuss the situation with you. If your assessment is ‘outside IR35,’ then it should be ‘business as usual.’ You will continue to invoice your agency or end-client in the usual way and you will be paid gross. You will account for your own taxes through your own PSC.

If you’ve been given an inside IR35 determination…

But if your end-client has found you to be ‘inside IR35,’ you will need to decide if you agree with that determination or not. Where you have been previously working ‘outside IR35’ on the same project, it will be particularly important to consider seeking expert advice. With a professional’s help, you can discuss your situation and prepare your arguments to ask your end-client to re-evaluate their assessment.

Post-April 6th 2021, the legislation will require end-clients to have a formal appeals process in place. Before that date, there is no legal obligation and end-clients are taking different stances on whether they will engage in re-evaluation and re-negotiation. Contractors have nothing to lose by asking end-clients to re-evaluate, but time is running out so this needs to be done quickly.

Your three options if still ‘inside’ after the status disagreement process

Ideally, a re-evaluation will result in an ‘outside IR35’ assessment, but if it doesn’t you will find yourself in the same position (see the chart), needing to decide what to do following an ‘inside IR35’ assessment. If you decide to remain with your end-client there are really three options:

1. Continue to work through your limited company (agency and client-policy permitting!)

The end-client or agency, whoever pays your invoices, will be obliged as the ‘fee-payer’ to deduct PAYE and NI from your invoice value before paying you. Under the new rules you will lose the 5% allowance that used to cover the costs of running your company, so you need to factor this in to your calculations.

2. Switch to a being a permanent employee of your end-client (assuming this transfer is offered!)

The upside of being a permanent employee maybe security, employment rights, pensions and benefits. The downsides go without saying -- loss of autonomy, flexibility and a reduction in take-home pay unless you can negotiate a new package.

3. Move to an umbrella company (or other form of PAYE, such as via your agency, assuming the agency offers such a service!)

This options offer some employment rights and protection, but without rate uplifts you will still take-home less monies. Some transfers to umbrellas might very well be confined to the umbrella companies on your agency’s PSL (Preferred Supplier List).

Re-negotiating your rate via umbrella or agency PAYE

This is far easier said than done. Many end-clients have expressed the view that these changes need to be ‘cost-neutral’ to them. Since agencies cannot afford to cover any rate increases, this leaves contractors in a difficult position. But all is not lost -- we are beginning to see some signs that end-clients are prepared to negotiate in certain circumstances. End-clients are very worried about the impact on their business that a loss of skills and experience would mean. Factors such as criticality to the project, and ease of hire, are all featuring in decisions to potentially increase contractor pay rates.

As a contractor when re-negotiating, remember to factor-in the following five:

- Employer NI and the Apprenticeship Levy. This is a very grey area and while the law states that this cannot be deducted from the rate paid to the contractor, in reality this is featuring in rate negotiations as it is a cost the Umbrella or Agency would otherwise need to cover.

- Umbrella companies or Agencies will have costs of employing you – these margins will need to be paid from your rate.

- You will no longer be able to claim for travel and subsistence

- What will your rights to holiday pay, sickness and parental leave look like?

- Will you be able to continue paying into your personal pension?

The future

Right now, you would be forgiven for thinking that the end of contracting looms! While we are experiencing turbulent times at the moment, we remain confident that the market will settle and outside IR35 opportunities for PSCs will continue to be available.

In the short-term, we expect to see far more ‘inside IR35’ roles on offer as PAYE positions -- arguably many of these should have been inside IR35 all along. But we will see quality ‘outside IR35’ opportunities available for highly skilled contractors operating their PSCs, too.

Lastly, look around a lot, because some forward-thinking agencies and end-clients are ahead of the IR35 reform game. They have worked together to assess correctly and have made changes where necessary. End-clients who made blanket decisions to stop using PSCs are already starting to experience project delays and a lack of talented resource. We think it is highly likely that having taken a break from using PSCs, these end-clients will want to hit the ‘reset’ button and will look to implement policies properly going forward that means there will be more ‘outside IR35’ opportunities in the future. Remember the public sector’s experience; in 2017, TfL was the first organisation to ban the use of PSCs, now ‘outside IR35’ opportunities are readily available in the public sector, including at TFL.