Contractor guide to your balance sheet

A guide on exactly what a limited company balance sheet is would be helpful to both veteran and newcomer contractors alike. But to be truly comprehensive, the guide would also demystify how you can use your balance sheet to unlock and understand your contractor limited company’s financials. So let’s get to it, writes Christian Hickmott, CEO of Integro Accounting.

What is a balance sheet?

In the simplest terms; a balance sheet is a statement that will show you what the company owns (‘assets’), what it owes (‘liabilities’), and the value of the owner’s investment (‘shareholders’ equity’).

Completed accurately a balance sheet is an incredibly useful tool. It can give you a financial snapshot of the health of your company at any given moment. And as we all hear frequently, knowledge is power!

With one look, the balance sheet will inform you if there is enough money in the company to pay all the amounts outstanding. Equally, and more importantly some might say, as long as the 'Retained Earnings' figure is positive, it will show you how much is available to the shareholders to draw as dividends from the company.

For these two reasons alone, this makes the balance sheet something you’ll want to keep as up-to-date as possible, so you always know exactly where you are without having to guesstimate.

What is included in a balance sheet?

The top half of the balance sheet deals with the business’s assets, as well as the business’s liabilities, followed by a total showing the assets -- less the liabilities.

The assets will be made up of:

- Fixed Assets

These include buildings, land, machinery, equipment, intellectual property rights (e.g. patents and trademarks)

- Current Assets

These include stock, cash and money owed to the company. Current assets can fluctuate in value from month-to-month.

The liabilities will be made of:

- Long-term liabilities

These are sums owed by the company that are not due to be repaid within 12 months such as mortgages and loans taken out on equipment or land.

- Current liabilities

These are any sums owed by the company that are due to be paid within 12 month, such as VAT and Corporation tax (and any other monies owed to HMRC). Also included is salary /salaries, and accounts payable (i.e. any sums owed to suppliers).

Following the assets and liabilities the third element on a balance sheet is the owner/shareholder equity.

What should contractors input into the owner-equity section?

Once you take the total of all assets, less the total of liabilities you are left with the owners’ equity. This is the amount that remains in the business available for the business owner(s) to withdraw.

The owner equity section will include:

- Share capital – funds raised in exchange for common or preferred stock.

- Retained earnings – profits earned to date once dividends or other distributions have been paid out.

- Paid in capital – this is also known as contributed capital and is any capital contributed to a company by investors.

How often is a balance sheet completed?

The balance sheet is typically completed as required for management reporting, be that monthly, quarterly or annually.

At a minimum it is advisable for it to be completed every quarter so the information is relatively in date. The more often the balance sheet is completed, the more useful it is going to be. Working with an accurate view of how your company is operating is an incredibly useful tool.

Who completes the company’s balance sheet – myself or my accountant?

It doesn’t matter if you complete the balance sheet or your accountant does it for you, as long as the information inputted is accurate and timely.

Many software programmes will automatically generate a balance sheet as part of their software, making it a simple process for you to maintain and be financially mindful yourself. At your year-end, your accountant will produce a balance sheet as part of your Statutory Accounts.

How to read a balance sheet

Before you can successfully start preparing a balance sheet, you’ll need to know how to read one!

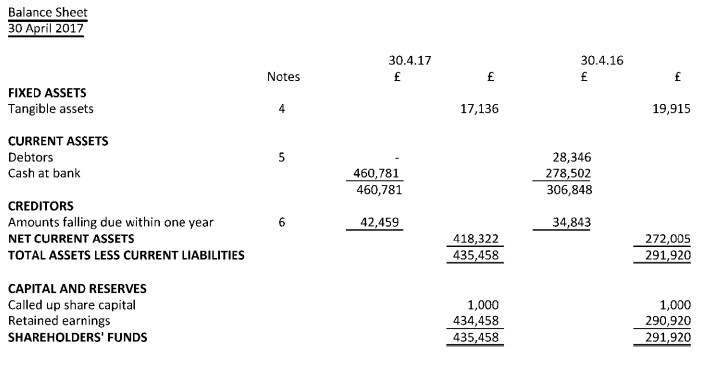

As already explained, the balance sheet is made up of three sections – assets, liabilities, and shareholder equity. Below is an example of a standard limited company balance sheet:

A balance sheet should always BALANCE!

If your balance sheet doesn’t balance, it will usually be because incorrect transactions have been inputted or there are transactions missing. Or it might be due to a miscalculation, or possibly an error in currency exchange.

The balance sheet is used to provide a financial snapshot of the business. It will be used to read, at-a-glance, what the business owns -- and owes. It is therefore a tool for not only business owners, but also potential investors, creditors and shareholders.

In addition, it is worth noting that one of the fiduciary duties of a company director is to know the financial situation of the company. Well, if the balance sheet is negative, it strongly indicates the business is insolvent and at risk of trading when it shouldn’t. So, contractor-director must make sure they know exactly where their company is at any given time. It’s pretty easy to do actually, as long as you keep accurate and timely records. I’m biased because I’m an accountant, but trust me, it will prove invaluable!

Still juggling?

For more guidance on various components of your limited company, or anything further you’re still trying to juggle in your mind about your contractor balance sheet, we recommend speaking to your accountant.