CJRS explainer: A contractor's step-by-step guide to the Coronavirus Job Retention Scheme

In recognition of the huge impact that Covid-19 is having on businesses and potential unemployment, the government announced the Coronavirus Job Retention Scheme (CJRS) on March 21st 2020.

The CJRS: in a nutshell

The scheme lets 'employers' (your limited company or, if not, your umbrella company) apply to HMRC for a grant to cover 80% of employees’ wage bills.

That grant is available up to a maximum of £2,500 a month -- per employee, where the employees remain on payroll but are temporarily not working during the coronavirus outbreak.

Extended by the government last week to run until June (not May as originally announced), and covering employees who were on the payroll on or before March 19th (not February 28th as originally announced), the scheme gives grants that will also cover the associated Employer National Insurance cost and pension contributions.

For contractors...

Now the CJRS is open, contractors want to know the steps to take and in what order; whether they’re eligible; what furlough means in practice and how much the scheme pays, writes Helen Christopher, operations director at Orange Genie.

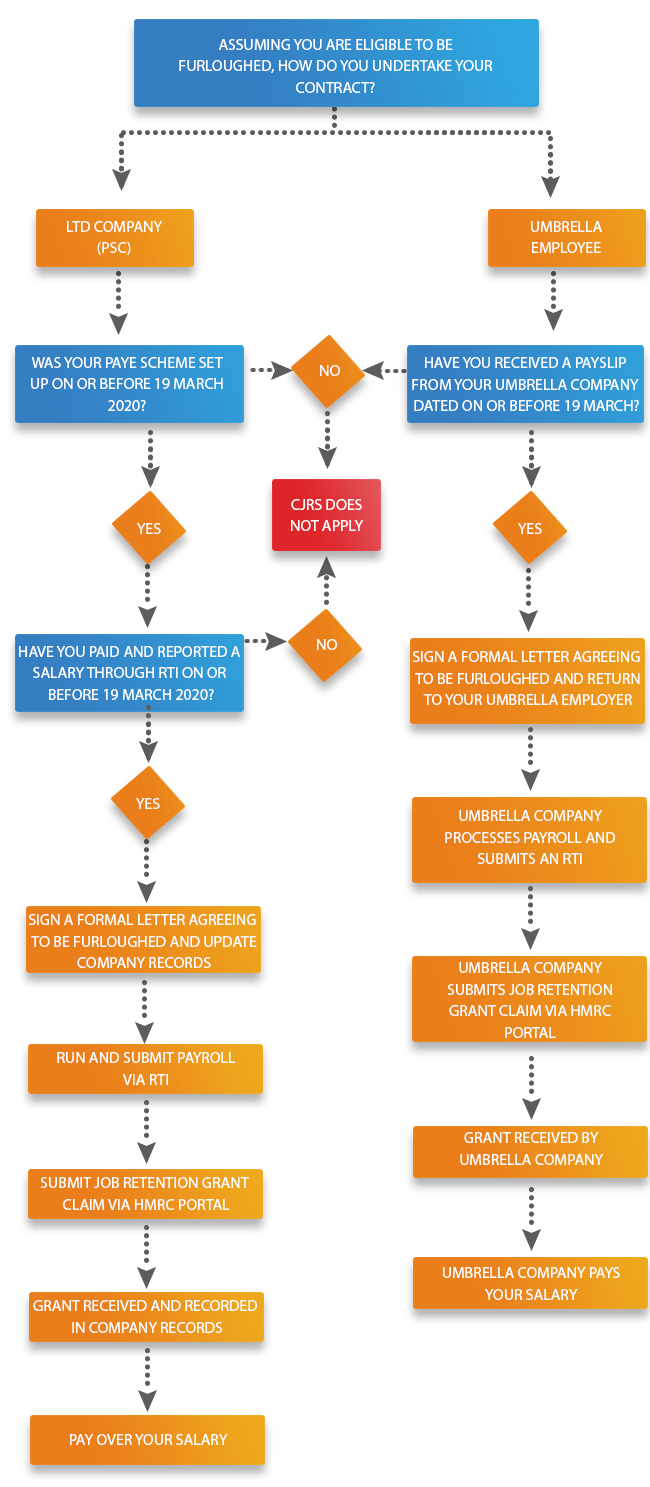

But first, here's that step-by-step to using the CJRS if you're a contractor, exclusively for ContractorUK:

Who is eligible for the scheme?

The government’s CJRS guidance has been changing regularly but in the latest update it is clear that the scheme applies to any UK employer with a UK bank account and a PAYE payroll scheme set up on or before March 19th 2020.

This latest guidance specifically includes workers employed by umbrella companies and salaried individuals who are directors of their own Personal Service Company (PSC), so it’s good news for contractors.

In order to make a claim under CJRS, your employer (your PSC/Ltd or Umbrella) must have furloughed you and certain criteria need to have been met. The flowchart above sets out the basic principles of how this can be achieved, both for PSC contractors and umbrella contractors (the employees of an umbrella company).

How does a contractor become furloughed?

It’s important to understand that if you can continue to work, then this is the better option (financially) for all concerned and CJRS will not apply. The CJRS is designed to allow businesses to press the ‘hold’ button, to ride out the current crisis and to bounce back as soon as possible with their loyal workforce still intact. The alternative for many businesses would be immediate staff terminations.

If your contract has been terminated or paused due to Covid-19, the decision to furlough you sits with your employer. As a PSC contractor, this will effectively be with yourself, and for umbrella contractors, it will be your umbrella company. Your employer should discuss furloughing with you and while you may be able to request that you be considered for furloughing, the ultimate decision sits with your employer.

It’s also important to remember that you can only be furloughed if your employer operated a PAYE scheme on or before March 19th 2020 and you appeared on that payroll before that date.

The furlough scheme small print

For a PSC contractor you should have been running a salary and declaring this through RTI by the above date. To be furloughed by your umbrella company, you should have undertaken work and received a payslip dated on or before the same date (March 19 2020). Unfortunately in both cases, if no such entry can be evidenced on your employer’s RTI submission, you may not be covered by the CJRS.

If you are therefore eligible to be furloughed, some formalities need to be completed. As a PSC contractor the decision to furlough yourself is fairly straightforward; in effect you are employer and employee. It is important that you recognise that you fulfil two functions in the business, employee and income-generator as well as director and office holder. You should arrange for a formal furlough letter to be prepared and in your capacity as employee you should sign and agree to be furloughed. You may also want to think about noting the decision to furlough yourself and any other staff you employ in a board minute to be retained in the company records.

If you are an umbrella employee, the process will be different. Your umbrella company will have worked with your recruitment agency or end-client to determine if your contract has been terminated or if other work is available. If it can be established that you are eligible to be furloughed, your umbrella will provide you with a formal furlough letter which you will need to sign and return, agreeing to being furloughed.

Payslip, payroll settings and submitting to HMRC

Having been furloughed your employer will calculate what can be claimed and what should be run through payroll. Once your umbrella / employer has done this, affected umbrella employees will receive a payslip, in the usual way showing you what you are being paid in a particular pay period. As a PSC contractor, you will need to run your payroll as normal – if you intend to only pay yourself the 80%, then you may need to adjust your payroll settings. Your accountant should be able to do this for you.

The final stage, then, is to claim the CJRS grant from HMRC. Umbrella company employers will submit one claim per claim period, and arrange to make payment to individual contractors shortly after receiving the funds. PSC contractors will need to submit their own CJRS claims or alternatively arrange for their accountant to do this on their behalf as their PAYE agent. Once the funds are received into the PSC’s bank account, you should pay yourself the full salary that has been claimed. The claims portal opened yesterday, Monday April 20th 2020.

How umbrella companies calculate your CJRS pay

Umbrella companies earn their income by charging their clients and recruitment agencies for the work carried out by the contractor as their employee. From their income, umbrellas have to cover the cost of employing the individual, including Employer National Insurance, Apprenticeship Levy and a workplace pension contribution, as well as their profit margin. The balance of that sum becomes the employee's gross pay for the period. Gross pay is made up of National Minimum/Living Wage as a contractual entitlement for all the hours worked, and a discretionary profit share (sometimes called ‘commission’ or ‘bonus’). The profit share element is so-called as it can change according to variable employment costs, including any reimbursement of business expenses and varied assignment rates paid to the umbrella company.

If an umbrella company was not paid by an agency for the work a contractor carried out, it would still be obliged to pay National Minimum/Living Wage as the employer, but as it had made no profit on providing the services, there is no profit to share.

What will be paid under the CJRS?

Current CJRS guidance advises that employers should calculate grant payments based on the regular wage that they are obliged to make and that discretionary bonuses or profit shares are excluded. This means (at the time of writing) that the guidance is interpreted to mean that umbrella employees are entitled to only 80% of the National Minimum Wage element of their salary. In an unprecedented collaboration, leading industry bodies the Freelancer Contractor Services Association, Professional Passport, REC, APSCo and Team have joined forces seeking urgent clarification from the government on this point, as without the inclusion of the discretionary profit share, thousands of umbrella workers are facing much less support than they perhaps anticipated.

For PSC contractors, the CJRS will only take into account salary payments; dividend payments are excluded. Assuming that you have taken a fixed annual salary, your payment will be calculated at 80% of the salary paid to you in the last pay period reported prior to March 19th 2020. You can, if you wish, continue to pay yourself 100% of your salary, using your reserves but you can only re-claim 80%.

Horses (not) for courses -- just a single course

This overview and flow chart to the CJRS covers many a contractor. But just like the scheme itself, a guide like this cannot cover absolutely every contractor, partly because the working practices, contractual circumstances and engagement scenarios of the UK’s flexible workers are extremely diverse.

Are you covered, for example, if you’re a PSC contractor who went offshore for a short time? Taking a first-principles approach, and as the scheme is open to all UK businesses with a UK bank account and PAYE scheme set up on or before March 19, if that contractor was engaged via their UK company on that date or in advance, then yes, you should be covered. That’s assuming you just happened to be temporarily providing services offshore. There is nothing in the CJRS guidance which would stop such a contractor from furloughing themselves through their PSC. However, if the contractor had used an offshore scheme and was engaged through an offshore company, they would probably not be eligible and could not claim.

This example underlines how, save submitting a Contractors' Question for an expert’s answer on ContractorUK, the complexities of both the scheme and people’s working arrangements suggest much pouring over the official CJRS guidance in the coming weeks. This flow chart and overview for umbrella and PSC contractors will hopefully help reduce that considerable time spent.