VAT pros and cons: When contractors should and shouldn’t register for Value Added Tax

Now that you and your contractor limited company are on top of VAT’s basics, let’s delve deeper into some contractor-specifics like IR35, some real-world FRS examples, and some numbers to bring into focus what we’re all understandably conscious of right now -- the bottom line.

Actually, as its name suggests, Value Added Tax is critical to that because in our experience, the more information that Personal Service Company contractors have on VAT, along with advice from their accountant, the better decisions they make for their business, writes Christian Hickmott, chief executive of Integro Accounting.

If you missed our first article which gave a basic overview of all things VAT, you’ll find it here. But let’s just recap the three schemes open to PSCs:

1. Standard VAT Scheme

Under this scheme your business must pay onto HMRC all the VAT charged to its clients through sales, depending on the type of sales the VAT rate can vary but typically the rate is 20%, less any VAT paid out.

2. Cash Accounting Scheme

Similar to the Standard Rate scheme, but on the CAS you only pay VAT to HMRC once you have received VAT from your clients. Likewise, you only claim VAT on your expenditure once you have paid the supplier.

3. Flat Rate VAT Scheme

Under the FRS, your business pays a fixed percentage of your total sales to HMRC, this rate is determined by the industry that you are in. Your business still charges clients at the standard rate.

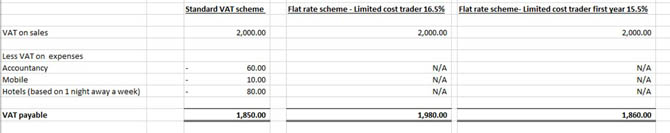

Take a look at the following table which depicts a scenario based on the FRS. Bear in mind, the flat rate scheme percentage will vary based on the business sector and the standard scheme will vary depending on what expenses are claimed. Nonetheless, the table provides a simple and useful comparison.

You’ll see that based on VAT on typical expenses for a contractor, it is (possibly surprisingly), more efficient to be registered on the Standard VAT Scheme than the Flat Rate Scheme, without the available discount of 1% in the first year.

However, the flat rate scheme with the 1% discount brings the VAT payable pretty much in line with the standard VAT scheme payment, based on some typical expenses you would expect a contractor to incur.

This illustrates how important it is to look at your options and their implications, along with talking to your accountant, before deciding about which scheme you should register for. It is not as simple as just looking at the figures -- you need to consider the other advantages (or otherwise) in play. Usually the answer most contractors come up with is the FRS -- it is less time-consuming in terms of admin, as it is simpler and therefore less stressful, plus it gives your accountant more time to get to know your business and what you will be claiming.

It’s also worth bearing in mind that if your business is on the standard scheme but no expenses are claimed, no savings will be made and again, the flat rate scheme could be the better option. As always, we recommend seeking professional advice before making your final decision.

When is it compulsory to register for VAT, and is there an exception?

The current tax year VAT threshold is set at £85,000, meaning that if over the last 12 months your business’s ‘taxable supplies’ (i.e. the total value of everything you sell that isn’t exempt from VAT, which is usually the same as your turnover), have exceeded the £85k threshold, you’ll need to register for VAT. Registration must take place within 30 days of the end of the month during which the threshold was exceeded so it’s imperative that you are aware of your turnover on a monthly basis, so you know immediately if and when you exceed the threshold.

Be aware, it is possible to apply for a VAT registration exception if you believe exceeding the threshold is only temporary and unlikely to happen again. You’ll need to apply for this exception at the time you know you have gone over the threshold, explain the circumstances and detail why it is a unique event, along with supporting evidence. HM Revenue & Custom may decline your application if your evidence is thin, in which case you will still need to register.

What if I do not register within the time required?

If you do not register within the 30 days stipulated, HMRC will still expect you to pay everything from the date that you should have been registered. In addition, they could also apply a penalty which will be based on how much tax you owe and how overdue you are in registering!

Another scenario where independent workers need to consider their options is if you are changing your business model, i.e. switching from a sole trader to a limited company. You will need to transfer the VAT registration ownership and can choose the right scheme for you. It’s simple to cancel or transfer a VAT registration; you do it online or by post.

If you are taking over a company, the previous owner must cancel their VAT registration before you can apply to transfer the VAT number.

When can you voluntarily register for VAT?

Aside from when you legally must register for VAT, you can voluntarily register for VAT at any time, even if your turnover is below the threshold. There are several reasons you may choose (or be advised) to register voluntarily, but broadly they all boil down to the same one reason -- it is in the best interest of your business to do so.

What are the benefits of VAT registration?

- Reclaiming VAT on your expenses (most goods and expenses purchased from other businesses);

- It could work to your advantage in the eyes of large companies as it will make your business look more credible and put you on a more equal footing;

- Given sufficient evidence, if you have bought business expenses prior to the company’s registration, you can reclaim VAT on the goods up to four years, and up to six months for company services.

Let’s explain this third benefit a bit more. For example, ABC Ltd purchased a laptop in June 2020. The company was not VAT registered until December 2020, but they can claim VAT on the goods purchased for the business.

Regarding services, ABC Ltd hired a business-planner in September 2020 and registered their company in December 2020. Well, again, ABC Ltd can claim VAT on the invoice raised for this.

It is worth noting, you can only apply these previous expenses on your business’s first VAT return.

What are the disadvantages of being VAT registered?

- It may put off companies which are not VAT registered from engaging your business as the costs will most likely be more than your competitors, who are not VAT registered.

- Being VAT registered undeniably involves more paperwork, organisation, and accounting.

Is it possible to de-register for VAT?

Yes, businesses can request for VAT registration to be cancelled if turnover falls below the £85,000 threshold.

In addition, you are obliged to cancel registration if your business ceases to trade, you stop making VAT sales or you join a VAT group.

If you stop being eligible you must cancel with HMRC within 30 days otherwise you risk a penalty. It’s simple to cancel and can be done online through gov.uk.

Alternatively, you can cancel by post with a ‘VAT7’ form. It will usually take three weeks for cancellation to be confirmed. You will have to submit a final VAT return for the period up to the cancellation date.

How is VAT applied on invoices?

VAT is simply added on your invoice to the price of the goods or services and this VAT charge must be shown separately on a full invoice.

The invoice will also need to display a unique invoice number along with the business’s VAT registration number.

Alternatively, for invoices on transactions below £250.00 there is the option to use a ‘simplified invoice.’ HMRC provides a breakdown on the contents needed for a full invoice and a simplified invoice here.

What happens if a contractor does business with a non-VAT registered client?

There should be no issue for a VAT-registered contractor doing business with a non-VAT-registered client. However, it is very likely that your costs will be higher than those of your business competitors if you are charging VAT and they are not.

How does VAT work with goods or services overseas?

The above query is possibly the most complex element of VAT, as there are many considerations to factor in , among them:

- Whether it is for goods or services

- Is the overseas country in the EU (until December 31st)

- Are you VAT registered?

- Is the other business VAT registered?

- The valuation of imported goods

- The reverse charge

- Returned goods relief

- The types of goods that you are purchasing/selling

- The types of services that you are offering/receiving

- VAT MOSS – digital services

- The place of supply

- Whether it is a B2B (Business to Business) transaction

- Whether it is a B2C (Business to Consumer) transaction

And many more, unfortunately! Due to the multiple variables on this topic, we recommend that you speak to an accountant for specialist advice, tailored to the VAT-related overseas scenario or transaction in play.

Are there VAT issues related to the off-payroll rules and IR35 reform from April 2021?

The simple answer, at this stage, is no, nothing is set to change. If you are working inside or outside IR35 through your own limited company, you still charge and collect VAT from your client and you still pay VAT to HMRC.

The only issue we foresee is that due to several industry sectors being ‘nudged’ to decree all contractors to go PAYE, HMRC will receive less VAT income from contractors. However, bear in mind they will also see an increased level of PAYE tax and NI due to this. From a contractor’s perspective and of course this is dependent on individual circumstances, with the upcoming changes to IR35, VAT should hopefully be one area you don’t have to factor in when navigating or adopting the status rule changes coming into place from April 6th 2021.