Not sure why this is news, surely the impact of VAT changes and bond/duty was part of the excruciatingly detailed impact assessments?

https://www.theguardian.com/politics...xit-uk-imports

https://www.theguardian.com/politics...xit-uk-imports

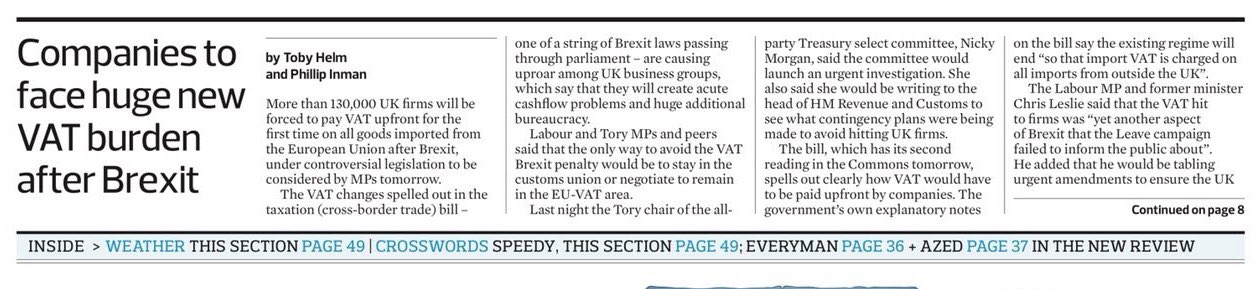

In a briefing sent to MPs, the British Retail Consortium, which represents 70% of the UK retail industry, said: “If the bill becomes law without any commitment to inclusion within the EU VAT area, UK businesses will become liable to pay upfront import VAT on goods being imported from the EU-27 for the first time.”

It added: “Liability for upfront import VAT will create additional cashflow burdens for companies, as well as additional processing time at ports and border entry points attached to the customs process. Mitigation measures could include companies instituting a revolving credit facility, or utilising import VAT deferment reliefs.

“Both measures require companies having to take out costly bank or insurance-backed guarantees, so would increase the costs of importing goods from the EU.”

It added: “Liability for upfront import VAT will create additional cashflow burdens for companies, as well as additional processing time at ports and border entry points attached to the customs process. Mitigation measures could include companies instituting a revolving credit facility, or utilising import VAT deferment reliefs.

“Both measures require companies having to take out costly bank or insurance-backed guarantees, so would increase the costs of importing goods from the EU.”

Comment