Originally posted by GigiBronz

View Post

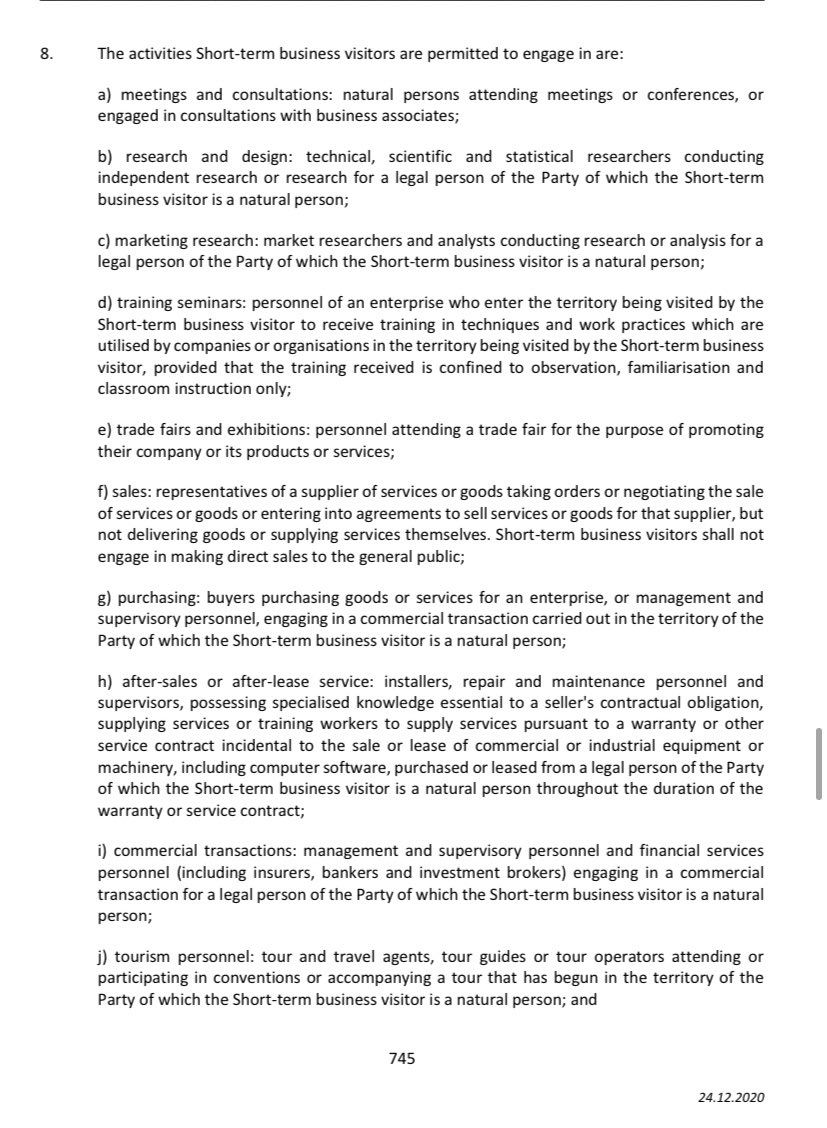

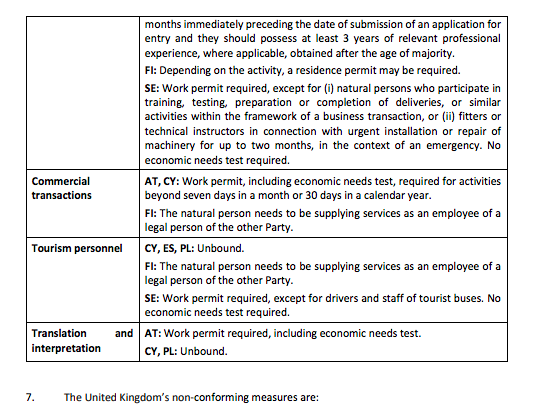

There will be limited changes on the Brexit VAT on services for B2B transactions after the UK leaves the EU VAT regime

Comment